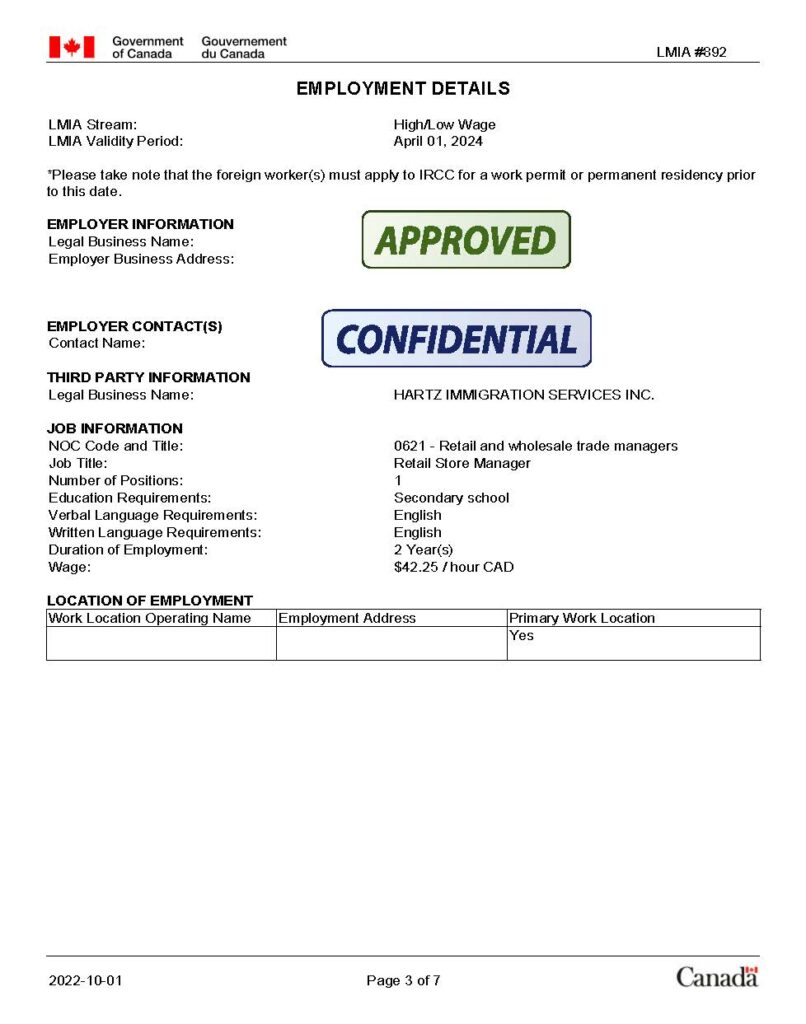

LMIA (For Employers)

A labour Market Impact Assessment is a document that an employer in Canada may need to get before hiring a foreign worker. A positive LMIA means that there is a need for a foreign worker to fill the job. It is a confirmation letter to show that no Canadian worker or permanent resident is available to do the job.

Employers who have not employed a temporary foreign worker in the past 6 years prior to submitting a LMIA application will be subject to a review. The employer must demonstrate that they made reasonable efforts to provide a workplace that is free of abuse and that they were not an affiliate of an employer who is ineligible for the TFW program or in default of any amount payable in respect of an administrative monetary penalty.

Document Required for Employers:

To demonstrate that you meet the conditions of the job offer, Employer must submit at least one of the following documents:

- T2 Schedule 100 Balance sheet information and T2 Schedule 125 Income statement information

- T2042 Statement of farming activities (redact social insurance number)

- T2125 Statement of business or professional activities (redact social insurance number)

- T3010 Registered charity information return

- T4 or payroll records for a minimum of 6 weeks immediately prior to the submission of this LMIA application, if the temporary foreign worker already works for you (redact social insurance number)

- an attestationconfirming that your business is in good financial standing and will be able to meet all financial obligations to any temporary foreign worker you hire for the entire duration of their employment

- if you are a foreign employer without a Canada Revenue Agency number whose business address and operation is outside of Canada, you may submit your contract or invoice for the goods or services that you are providing in Canada.

If you have not received a positive LMIA decision in the past two years, you must submit at least one of these documents to demonstrate that you have a legal business that provides a good or a service in Canada.

- municipal/provincial/territorial business license (valid, for example not expired)

- T4 Summary of remuneration paid

- PD7A Statement of account for current source deductions

- an attestation confirming that you are engaged in a legal business that provides a good or a service in Canada where an employee could work and a description of the main business activity. Permanent residency stream only, confirmation that the business has been operating for at least one year must also be included in the attestation.

- if you are a foreign employer without a Canada Revenue Agency number whose business address and operation is outside of Canada, you may submit your contract or invoice for the goods or services that you are providing in Canada

- a copy of the Coasting Trade letter of authority issued by the Canada Border Services Agency for positions onboard a foreign vessel undertaking coastal trade in Canadian waters.

For all trucking applications:

Regardless of your history with the TFWP, if you are submitting LMIA applications for trucking positions, you must submit the following documents with your application:

- Current copy of your carrier profile / public profile document

- National safety certificate number, and

- Current fleet insurance

For all private household employers:

Regardless of your history with the TFWP, you must provide your most recent Canada Revenue Agency notice of assessment (NOA) and documentation showing your income exceeds the low income cut-off (LICO) produced by Statistics Canada if you are a family or private household hiring a worker. (Submit previous year NOA if LMIA application is submitted after July 1st. Submit a rationale for consideration if, due to an extraordinary circumstance, the most recent year NOA is not available).

Processing fee

Employers must pay $1,000 for each position requested to cover the cost of processing a Labour Market Impact Assessment (LMIA) application.

Families or individuals seeking to hire a foreign caregiver to provide home care for individuals requiring assistance with medical needs are exempt from paying the Labour Market Impact Assessment application processing fee.

Families or individuals with a gross annual income of $150,000 or less, seeking to hire a foreign caregiver to provide childcare in their home to a child under 13 years of age, also qualify for the processing fee exemption.

There will be no refund in the event of a negative LMIA, or if the application is withdrawn or cancelled by the employer since the fee covers the assessment process and not the outcome. In addition, if a live-in requirement is found during the assessment of the LMIA application, there will be no refund.

Refunds will only be available if a fee was collected in error (for example, an incorrect fee amount was processed).

Employers must be aware that Employment and Social Development Canada (ESDC), has a policy that prohibits employers and third-party representatives from recovering the LMIA processing fee from temporary foreign workers (TFW).

Applying for LMIA in Canada can be tricky and confusing, let us help you complete LMIA applications with ease. Please do no hesitate to contact us for processing an LMIA application today.